A pending regulation by the Federal Acquisition Regulatory Council would require firms that receive more than $7.5 million in contracts annually to disclose greenhouse gas emissions from their business and supply chain – putting a bullseye on the back of the steel industry, which worldwide accounts for 8% of annual greenhouse gas emissions.

Contractors above $50 million also will need to disclose emissions from subcontractors and suppliers, conduct a climate risk assessment and set non-binding greenhouse gas reduction targets. In a Feb. letter, U.S. Senator Joni Ernst (R-IA) wrote extensively about her opposition to the regulation, noting tracking supplier emissions is going to impact even the smallest of contractors.

“If a small business owner determines there is no business case for staying in or entering the federal marketplace due to the high regulatory burden, they will leave the federal marketplace altogether, leaving fewer vendors capable and willing to meet government's needs,” she wrote.

But Randy Charles, metallurgist and founder of Greenway Steel, says this pending regulation isn’t the only front contractors are facing in the decarbonization battle – and not all of them only impact federal contractors.

2023 building decarbonization legislation recap

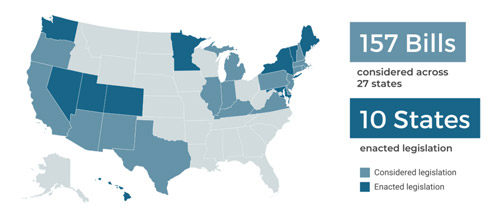

Decarbonization legislation passed across 20% of U.S. states this year, according to the National Caucus of Environmental Legislators.

Decarbonization legislation passed across 20% of U.S. states this year, according to the National Caucus of Environmental Legislators.

In Feb. 2022, the Securities and Exchange Commission proposed a draft rule to enlist companies in calculating and disclosing their climate-related costs. In May, the Biden administration made low embodied carbon procurements a priority in agency purchases and implemented emissions reduction targets. Then at the state level, states like California have cap and trade. New York and Vermont also passed strong building decarbonization legislation this year, according to an analysis by the National Caucus of Environmental Legislators.

“Utility providers and suppliers of purchased goods also may have targets already established. Many large public companies have been communicating their targets through sustainability reporting. Targets are being established for 2030 and 2050, but a lot can happen between now and then,” Charles said.

Sweden aims for commercial scale green steel by 2026

Speaking at the summer Metal Construction Association's 40th annual meeting, Charles said the U.S. seems to be a couple years behind the EU on regulatory developments and initiatives, particularly hydrogen. However, the US is globally leading in terms of low greenhouse gas emissions related to steel production.

Sweden and the EU have been more motivated on the transition to hydrogen owing to the continent’s reliance on older blast furnace technology as opposed to electrical options. The U.S. fleet of electric arc furnaces, which now account for 70% of domestic steel production, are powered by electricity. And this is a step up from the blast furnaces that still dominate Europe’s steel industry with a 75% higher carbon intensity. Sweden also has abundant high-flowing water to supply power for producing green hydrogen that the country can develop economically, Charles said.

He noted Sweden has supported a green transition for its steel sector with its state-supported enterprises, replacing the carbon intensive coking coal input with fossil-free hydrogen power at SSAB Oxelösund. Full commercial production will begin in 2026, with customers like Volvo and others committing to purchases to improve their emissions reduction goals and environmental, social and corporate governance (ESG) scores.

Recycling and upcycling scrap metal

Metal fixtures can give buildings lower lifecycle emissions than cheaper alternatives, owing to less frequent replacements. This has increasingly led to institutions requiring bids using the hardy material. To achieve green building certifications, recycled metal also helps.

“Majestic Steel is a big name in the HVAC space, and they’re doing their part in purchasing recycled steel,” Charles said, adding they also have a recycling program. The flat rolled steel supplier says on their website that they pass the savings from using scrap steel on to manufacturers.

Majestic Steel’s scrap recycling program saves 132,000 lbs of steel from landfills every year. And with more companies like Boeing jumping on board, contracting a recycler for all their aircraft to be disassembled at the end of their life, the metal recycling industry is ballooning in size. Domestically, the industry had a growth rate of 5.9% per year on average between 2017 and 2022.

“People are going to start looking at, once a product is over, 'what do I do to make sure it doesn't get back into the landfill,” Charles said. “And they have options.”

In 2022, U. S. Steel recycled approximately 3.0 million metric tons of blast furnace slag and 204,540 metric tons of steel slag.

“A circular economy is really developing here, from the producer to the manufacturer,” Charles concluded.

Source: U.S. Steel Industry Shows Leadership in Building Decarbonization | ACHR News